You need to lower a loan before or on the 1st of the month you want to receive a lower amount.You need to stop a loan before or on the 1st of the month you no longer want to receive the loan.Behind 'Rentedragende lening', choose 'Aanvragen', 'Wijzigen', or 'Stopzetten'.Go to 'Mijn producten' and choose 'Studiefinanciering'.A supplementary grant becomes a gift if you graduate within 10 years, an interest bearing loan does not.Īpply for, change or stop an interest bearing loan The amount depends on the type of tuition fees you are due: statutory tuition fees or institutional tuition fees.īefore applying for an interest bearing loan, check if you are eligible for a supplementary grant. If you are in HBO or university, you can borrow an extra amount to pay for your tuition fees. The Amounts page states how much you can borrow. Check the repayment rules page for more information.

You have 15 or 35 years to repay your loan after completing your studies, depending on the repayment rules that apply to you.

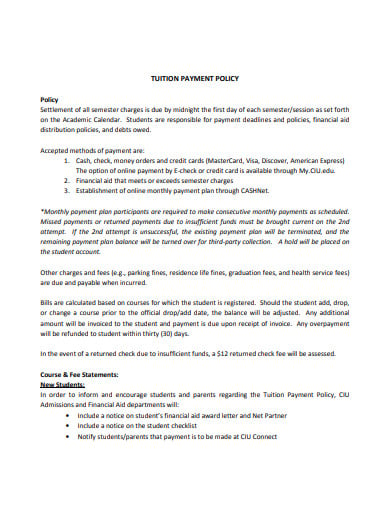

LOANS FOR PAST DUE TUITION PLUS

After that, interest is calculated based on the amount of your debt plus any interest that has already accrued.

The loan is subject to interest from the month you receive it.

0 kommentar(er)

0 kommentar(er)